Forex Order varieties

Forex trading is that the process of currency exchanging wherever one currency swap into another currency i.e. the exchanging of in to dollars within the forex market, this can be viewed as buying dollars whereas, at the same time selling Indian currency, this process forever performs on pairs with the exchange rate managed by the forex trading market.

Making the primary Forex Trade

Before taking any step within the forex market trader has to make some basic strategies and follow the given steps.

Open a observe forex trading account is that the 1st ought to begin. Most of the new traders like the observe account that may facilitate to manage a time period account, here we overcome the risk of losing our hard cash.

Do this observe for a minimum of a few weeks or a month and so built an honest assessment of your strategy. you’ll update your designing with time as you get experience and continue practicing till you’ve got the confidence to trade with the particular trading account.

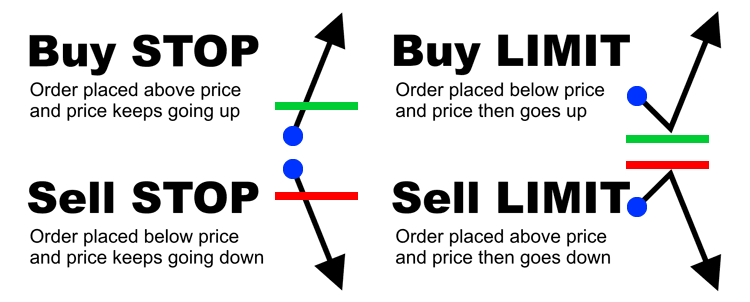

Most brokers provide the given order types:

Market Orders– A market order is performed instantly when put. it’s priced using the present spot, or market value. A market order instantly becomes an open position and direct to fluctuations within the market.

Limit Orders– A limit order is an order to trade a currency pair, however, only when definite conditions included within the inventive trade info are consummated. until these situations are met, the order is measured a pending order and doesn’t influence your account totals or margin estimate.

Take Profit Orders – A take-profit order repeatedly terminates an open order when the exchange rate gets to the specified threshold. Take-profit orders are utilized to lock-in benefits after you are unavailable watch your open positions.

Stop Loss Orders – kind of like a take-benefit, a stop-loss order may be a suspicious mechanism you’ll be able to use to help protect against extra losses, together with avoiding margin closeouts. A stop-loss automatically closes an open position when the exchange rate moves against you and reaches the amount you specify.